Price positioning is one of the many crucial decisions for those venturing into new trade regions like the Southeast Asia or Indo-pacific region. This region is far from a homogeneous marketplace. In fact, it is highly likely that you will need different price positioning for multiple separate groups of customers in different geographical areas within that region.

As an example, Singapore and Malaysia are bordering countries and members of ASEAN, but very different in social, legal, economic, political and technology contexts. Simply put, the markets are unified under the ASEAN framework, but highly fragmented and unique, and as such each market needs different entry and development treatment.

Competition should be reviewed and assessed during the trade readiness stage.

Price decisions must be made based on factual market intelligence and a logical thought process which takes into account customer demand (price elasticity), total addressable market, cost function, logistics, and competitors.

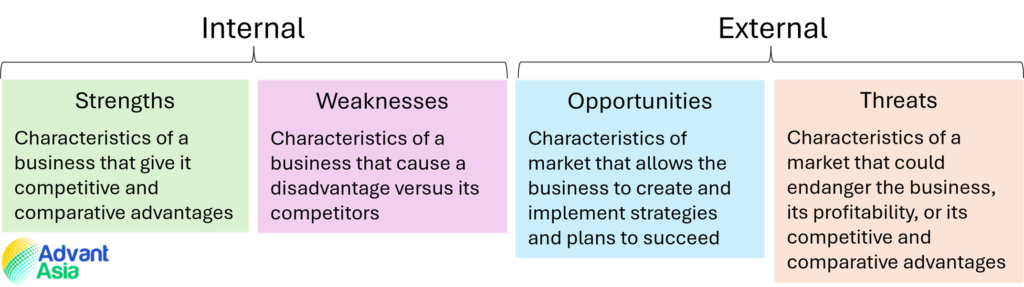

A SWOT analysis (figure 1) should be completed, keeping in mind that you will most likely be facing local and imported brands. Without exceptions all competitors and alternatives must be reviewed and analyzed.

High-end elite and luxury brands command a price premium in most global markets. However, as a new entrant you may not be able to leverage your home market brand equity. In that case, you will need to build brand equity to achieve that premium price.

There are 4 stages to reaching that premium price level:

- establishing brand awareness

- building brand acceptance

- attaining brand preference

- achieving the “holy grail of branding”, brand insistence

All of this this takes time and investment.

There is a longer-term hierarchal approach to developing an international or overseas market. This approach begins with exporting your product to your new market – entering it for the first time. When the business builds traction and gains momentum, a local sales and marketing support office and inventory can be established.

Investing in local production assets eliminates value-detractor costs like shipping, handling fees, and duties (depending on relevant trade agreements). Moreover, local production could serve as an export platform to neighbouring countries as you expand geographically to continue growth.

In this hierarchical approach a company may accept lower profits to fast-track the initial stages, with the intention of maximizing profitability during the growth stage after investing in local production. This is often referred to as the “market entry fee”.

Not many companies will consider foreign direct investment (FDI) without first establishing a sustainable and scalable business model.

Again, it’s important to be patient. Establishing a foundation for a business could take three to five years.

5 pricing strategies to consider

Price positioning options should be evaluated, and a pricing strategy selected during the trade readiness – situational analysis and strategic planning stage.

There are many different price positioning options available, depending on:

- route to customers

- layers of distribution – retail or wholesale

- business-to-business (B2B)

- business-to-consumers (B2C)

- type or nature of the business

As an example, if you’re selling through a distribution network, the business model is business-to-business-to-consumer (B2B2C).

Multiple layers of distribution can be effective at reaching large or remote target customer segments. However, additional layers increase consumer cost, and it’s crucial to be mindful of this when selecting a pricing strategy.

There are many pricing and price configuration strategies to consider, and a business needs to decide the most effective strategy to achieve financial and non-financial objectives for each market and segment.

Selling directly to consumers or through a distribution network will also influence the price strategy choice. Most businesses entering the Southeast Asia or Indo-pacific region will sell through a distribution or channel partner network.

The most popular and relevant pricing strategies are premium pricing, penetration pricing, competitive pricing, cost-plus pricing, and value-based pricing.

1. Premium pricing

Premium pricing sets a high price for products or services reflecting superior quality, customer experience, and exclusivity. This strategy works well in the luxury goods segment where products are highly differentiated and unique with strong consumer brand affinity.

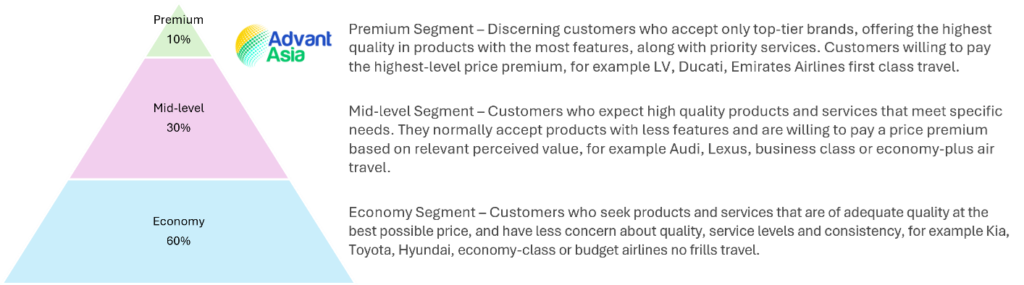

However, in most emerging and developing markets there are three distinct customer segments – premium, mid-level, and economy (figure 2).

The premium segment may be profitable, but it may also be the smallest customer segment with limited growth potential. Product and price positioning must be organizationally aligned with target markets and customer segments.

2. Penetration pricing

Penetration pricing is a strategy that sets the price lower than marketplace pricing to more quickly gain market-share. The idea is that lower prices will attract a larger number of customers. The profitability focus is higher-volume lower margin percentage, but higher margin dollars based on volume.

As an example – $1m sales at 50% GM = $500k margin dollars. $3m sales at 40% GM = $1.2m margin dollars. Ten percentage points lower, but 140% or $700k additional margin dollars.

The premise is as market share is built and brand equity develops and customer loyalty is gained, you can gradually increase your prices.

This strategy can be highly effective at penetrating intensely competitive markets where lowest price prevails and is the determining factor in deciding brands and suppliers.

However, it will be extremely challenging at any time to increase prices without alienating customers, especially if you’re the only one increasing. On top of that, competition will retaliate and it becomes a race to the bottom, and a race that’s unwinnable – in most cases local manufacturers will have lower cost structures.

3. Competitive pricing

Competitive pricing is a strategy that prices products similar to brands already available in the market. You should also review products that are dissimilar that could be used as an alternative.

As an example, a nut and bolt and a rivet, both are mechanical fasteners similar in functionality but different. The rivet might be more expensive but it’s faster to install and offers an overall consumer cost-savings (the value proposition).

Alternatively, you could price your products slightly lower as you would with a penetration pricing strategy, but Southeast Asia or Indo-pacific markets are intensely competitive, and competitors will respond aggressively.

4. Cost-plus pricing

In my opinion, this is the most overused and simplistic method to establish pricing. This strategy factors in all contributing fixed and variable costs to establish a selling price to distribution with a fixed margin.

In most cases incoterms are FCA (free carrier), channel partners and customers arrange to have loaded containers collected from the manufacturer, trucked to rail yard, railed to port, and port to export destination.

The strategy is simple and generally applies to all products across all regions, markets and segments. The downside to this strategy is that it doesn’t take the consumer or market price into consideration. The strategy also excludes regard for channel partner margin, and if your product line is not profitable and salable, channel partners will soon lose interest.

5. Value-based pricing

Value-based pricing is grounded on target customers’ perception of value. I have found this strategy to be most effective in determining the right price to drive revenues and maximize profitability for companies and their channel partners.

The price point is determined using a demand curve that illustrates the relationship between demand at different price points. Corelate that data with VOC (voice of customer) to determine the threshold of affordability – in essence what the target customers are willing to pay for the products or services, considering the added value being delivered.

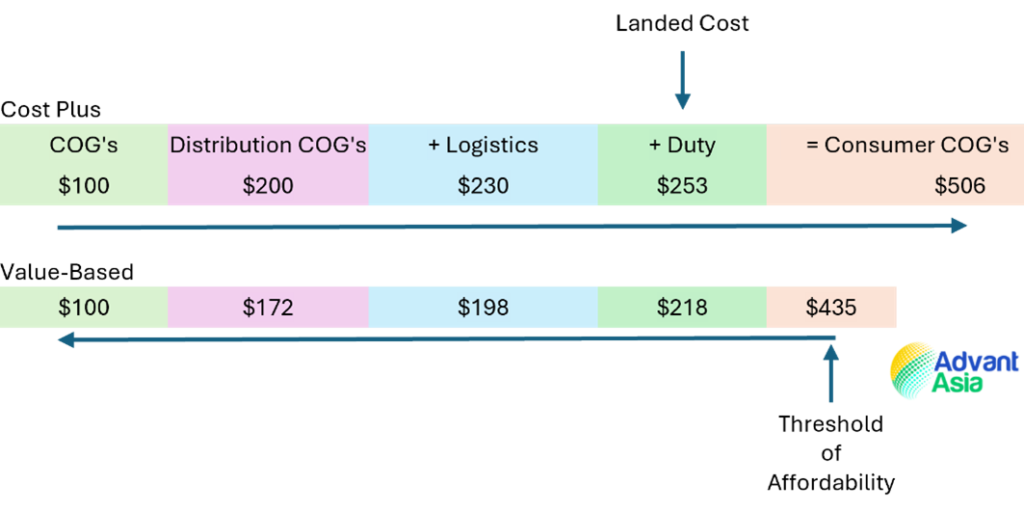

Figure 3 compares cost-plus and value-based pricing strategies.

The difference is determining the market price first as the threshold of affordability, then working backwards. Subtract distribution margin, duties (if applicable) and logistics cost. That will determine the distribution selling price or distribution cost of goods.

The difference in profit between the two is cost-plus delivers 50% margin, and value-based 42%. As explained in the penetrating pricing section, you may need to accept a lower margin to increase demand.

The goal when determining a pricing strategy is to rapidly develop market share and drive profitable revenues for the business and any channel partners while considering the threshold of market and customer affordability.

As mentioned, this might take some experimenting before you get it right, that’s to be expected. Take the time to get it right, pay close attention to competitors and fully understand their key differentiators and value propositions.

Let research and data and a logical thought process drive your product and pricing decisions.

I found your recent article on pricing quite interesting. However if you are selling to some kind of distributor (not an exclusive distributor) you will most likely be selling on a CIF basis. It is interesting to know the duty, but if selling for cash or CIF, then it is not part of the calculation, Unless, you have set up your own distribution company in the target country. Then it is very important.

Original article: https://tradeready.ca/2024/featured-stories/5-pricing-strategies-for-international-markets/?

Great point and thank you for mentioning and reading. I absolutely agree, incoterms influence pricing, I tried to example the build up of associated costs that impact end customer prices using a simplified formula. The example used models the incoterms we follow today FCA (free carrier) selling to a global distribution network. Also, with FOB and CIF revenue is typically recognized and risk shifted once the goods are on board. With FCA this happens when the goods are loaded at the manufacturer.