Trade agreements are great but you still need a breakthrough strategy

By signing the CPTPP agreement, the Canadian government has provided greater access to the Asia-Pacific/ASEAN region and new customer opportunities. However, the CPTPP is not a silver bullet to successfully building your ASEAN export business. While the agreement will result in the reduction of tariffs and non-tariff barriers, these changes will be phased in over a ten-year period.

To rise above the myriad of competitors and succeed in the ASEAN region you will need a well-designed market-centric strategy, elite salespeople, dedicated channel partners and a pathway to the biggest and best customer opportunities. Your level of regional knowledge, experience, and commercial expertise will make the difference between exceptional or mediocre growth, and as such, exporting companies should consider contracting professional help to direct their ASEAN expansion.

Simplify and focus your strategy for the best results

As a strategic marketing and business development professional with two decades of experience building businesses in Asia, I believe a simplified, focused and disciplined approach works best.

A strategy tailored to effectively cover and penetrate ASEAN’s diverse and hugely fragmented market has two key pillars. Firstly, markets and marketing strategy determines where and how to compete, and more importantly how to win based on facts and logic supported by keen analytics. Marketing also plays a key role in unifying and aligning the functional parts of the business into a coherent approach.

Secondly, an effective communications strategy needs to include both digital and personal forms of customer engagement. These efforts then need to be linked to CRM (customer relationship management) and other sales technologies to form a structured, integrated selling methodology

Invest in the best sales leadership and develop the rest

The Asia-Pacific region is intensely competitive. The market contains many multinationals as well as intra-regional rivals, all competing at varying levels of quality and price-points. Moreover, customer buying behaviors and value perceptions differ significantly throughout the region. Sales is the front-line face of your company and vitally important to gaining distribution and customer trust and confidence. Ironically a recent study conducted by Objective Management Group (OMG) revealed the Asia region ranks highest in percentage of weak salespeople

In this context, an elite salesforce needs to become your competitive advantage. Developing one starts with investing in regionally experienced and commercially competent leadership capable of recruiting, coaching and developing the skills and effectiveness of your direct and distribution salespeople. Furthermore, to truly differentiate and rise above your competitors, you must establish a structured, effective, start-to-finish selling process based on set milestones with supporting CRM and sales enablement technology.

Whatever methodology, process and CRM platform you choose, developing your salespeople is essential. Companies selling in the ASEAN region should avoid a few common misconceptions of recruiting salespeople:

- Recruiting product experts as salespeople does not generate product enthusiasm or win customers. It’s better to hire, train, coach and develop talented salespeople.

- Poaching salespeople from competitors will not convert customers, as top customers are loyal to brands and local distributors. You may convert a few small scale customers but you need to focus on the biggest and best selling opportunities and these prospects need a compelling reason and material gain to change.

- Recruiting sales managers and designating them as sales directors does not give you access to more high-quality customers, or improve a manager’s selling skills. It’s better to train your salespeople and promote them once their skills meet the level required by the position.

This model serves as an example, showing the integrated process I developed for Asian markets.

Integrated markets, marketing and selling model

4 criteria to choose the right partners

A well-designed distribution network is essential to optimize customer reach and accelerate growth. Assessing your partners should include the following criteria:

- Can the partner access your target customers? The right channel partner will have strong customer relationships that you must exploit. Make joint customer visits to gauge their relationships through customers interactions and engagement. Customer visits with favorable responses to new products and brands will elevate your value to the channel.

- Does the partner have the financial resources to support market entry and growth? Supply-chain interruptions due to unexpected financial limitations will impair growth.

- Does the partner have sales and marketing resources to proactively sell your products? ASEAN distribution channels are improving their commercial capabilities by establishing business development / product specialists to drive growth of select products to expand customer-share. Partnering with these more sophisticated partners will prioritize your products and accelerate growth.

- Can you and your potential partner agree on prices that are market competitive and profitable for both parties? Product positioning should be defined in your markets and marketing strategy and refined with partners as you create the communications strategy for specific countries, verticals and target customers. Fair and equitable partner profit begins with accurate product and price positioning. To achieve this, use a value-based pricing model. Determine the price for customers in each market by including a value-add premium and reversing distribution margin, duty and logistics costs to arrive at the distribution exworks cost price. Using a typical cost-plus pricing strategy may extend you beyond the threshold of acceptability and impede growth. You also need to think long-term: price your goods based on what will be best for long-term progressive revenue and profit growth, rather than immediate profit percentages.

Consider the longer-term progressive trajectory:

- Entering the ASEAN region by launching your export business

- Establishing a regional presence through a representative office

- Establishing a trading company to better serve customers gained

- Foreign direct investment (FDI) to localize supply chain and maximize profitability

Think of the longer-term financial gains – is a flagging $2m start-up business with 50% gross margin more appealing than a $5m scalable business with 43% gross margin?

Value based vs. cost plus pricing model

Choosing customer categories and precision targeting is critical

You must focus on developing the biggest and best opportunities, rather than those on the peripheral. Choosing customer categories and precision targeting the best opportunities is one of the most crucial decisions facing both new entrants and established companies.

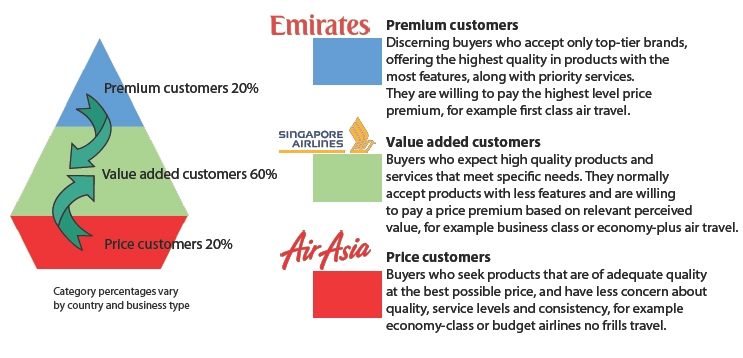

The ASEAN region consists of three distinct customer categories with unique buying characteristics; premium, value-added, and price customers. Customer categories should be evaluated and determined in your chosen markets based on strategic intent and alignment. From my experience, the value-added category is rapidly growing. Both premium and price customers migrate into the value-added category seeking products and services that align best with specific needs within the threshold of price acceptability.

Customer categories model

The biggest and best customer prospects need to be determined by precision targeting based on economic value and probability of success modeling. Every business has unique probability of success factors that need to be leveraged as relevant to customer differentiators.

Your probability of success factors could include complex problem solutions, superior products, localized technical support, immediate supply, brand affinity, top-tier channel partners, trade terms, or compliance. Evaluate these regularly, as situations often change and your probability of success can change rapidly.

Based on the chart below, prospects in category 1 (high value, high probability of success) require 80% of your focus and those in category 2 require the remaining 20% focus. Category 3 (low value, high probability of success) should be developed directly by channel partners, and category 4 (low value, low probability of success) can be ignored. Stay focused on the 80 but stay connected to the 20 as they often pivot, and when they do – you want them to pivot to you!

Precision 80/20 customer prospect focus model

Use digital and personal approaches to reach a wide audience

Digital media is borderless (in most cases) and highly effective in reaching new customer prospects, but your content must be relevant and engaging. Posting social media cut-and-paste product images and inviting opportunities to provide more information or to quote a price is largely ineffective.

Instead, show a quality image of your products in an application, reference the customer to gain credibility, and explain the value proposition and customer gain. Direct customers to your website and connect your prospects with local channel partners. This removes language barriers and more quickly connects buyers with sellers in the same timezone.

Trade shows provide an excellent first contact platform with customer prospects, but you need to be selective. To manage costs, consider country and industry specific trade shows versus larger, interregional or international exhibitions.

As an example, while contracted to help a safety footwear SME expand beyond Singapore, my analytics supported a significant opportunity overlooked in the Manila Philippines construction sector. Participating in the right tradeshow (Worldbex) immediately accessed more than $2.5 million in new business with the two largest construction companies in the Philippines. It’s very unlikely that these prospects would have been discovered during an international or ASEAN regional tradeshow outside of the Philippines.

Research, prepare and be ready to call upon the experts

In international trade, know-how is survival. Take all the steps to ensure you have the knowledge and information you need so that you’re prepared to take advantage of the opportunities while minimizing the risks.

Knowledge of the region and your commercial expertise will make a difference, but an important part of success in trade comes from knowing when to call in the experts.

disqus comments